Temasek’s Pavilion Capital backs South Korean AI chip maker Rebellions with $50M investment decision – TechCrunch

Worldwide undertaking money corporations are pouring dollars into the semiconductor startups producing the up coming generation of chips. Semiconductors, which have come to be a valued asset, are made use of in pretty much almost each and every industry, like 5G networks, automation, the Online of Things, financials, clever residences, intelligent cities, virtual actuality (VR), augmented actuality and self-driving cars and trucks.

Sunghyun Park, a former quant developer at Morgan Stanley in New York, released artificial intelligence semiconductor startup Rebellions with four co-founders to enter this red-scorching business in 2020. Nowadays, the South Korea-primarily based enterprise that builds chips built for artificial intelligence programs, introduced it has lifted a $50 million (62 billion KRW) Series A from traders, which include Temasek’s Pavilion Money, Korean Enhancement Financial institution, SV Financial commitment, Mirae Asset Funds, Mirae Asset Ventures, IMM Expenditure, KB Expenditure and KT Investment.

Its current backers Kakao Ventures, GU Equity Associates and Seoul Techno Holdings also participated in the spherical, Park advised TechCrunch.

The Series A, which was oversubscribed — the business in the beginning qualified around $40 million — and wrapped up in much less than 3 months, brings Rebellions’ whole funding lifted to about $80 million (100 billion KRW) at an believed valuation of $283 million (325 billion KRW), CEO of Rebellions Park mentioned in an interview with TechCrunch.

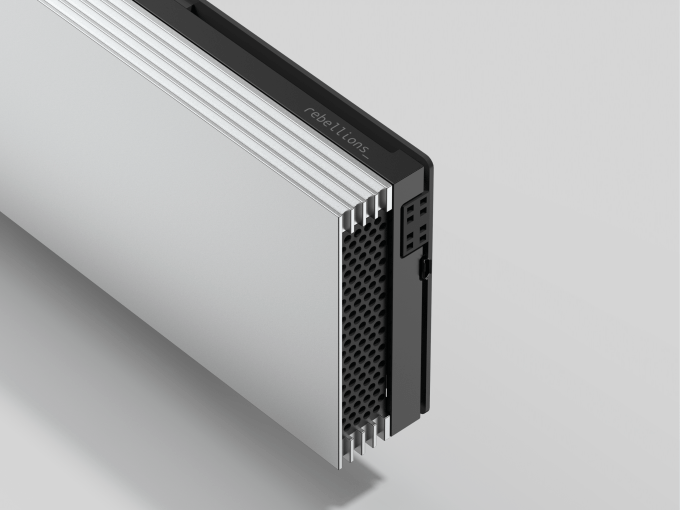

The startup will use the capital to mass-make its next AI chip prototype, identified as ATOM, which will be applied in enterprise servers, Park mentioned. Moreover, the funding will be utilized to double its headcount to 100 staff members, and set up an place of work in the U.S. by the conclusion of this year, Park continued.

Rebellions is in talks with potential buyers to get its first AI Chip, identified as ION, into the marketplace. The company’s ION clients could consist of worldwide expenditure banking institutions, and its next chip ATOM targets massive companies in the cloud sector and info centers, Park included. It has lined up Taiwan Semiconductor Production Company (TSMC) to start producing the ION chips as early as subsequent 12 months.

The company claims that its to start with chip ION, produced in November 2021, improves investing speeds and cuts down latencies and is two moments quicker than Intel Habana Labs’ AI Chip Goya in phrases of execution. That usually means Rebellions’ ION enables speedier details execution, so that direct orders can be processed a lot more quickly and profitably than traders with slower execution speeds. High-frequency trading (HFT), or systematic trading, is an automated trading system used by big expenditure banks, hedge money and institutional buyers to transact a big quantity of orders.

Impression Credits: Rebellions’ AI chip ION

Park experienced earlier helped structure a Starlink ASICs chip at SpaceX, and worked as an engineer at Intel Labs and Samsung Electronics.

There are additional than 50 AI chip makers in the earth, such as Samba Nova, Graphcore, Groq and Cerebras, wanting to challenge AI processors from Nvidia, Intel and Qualcomm, according to Gartner analyst Alan Priestley. Intel acquired Israeli AI chipmaker Habana Labs for about $2 billion in 2019 even though Qualcomm picked up Nuvia for approximately $1.4 billion in early 2021. The AI chip current market is projected to be value around $83.2 billion by 2027, up from $56 billion in 2018, per a 2019 report by Perception Associates.

Venture capital funding for worldwide chip startups more than tripled 12 months in excess of calendar year in 2021, with $9.9 billion invested throughout 170 discounts, for each PitchBook.